does td ameritrade report to irs

TD Ameritrade does not report this income to the IRS. January 15 2021 723 PM.

Is Td Ameritrade Safe Legit Is Td Ameritrade A Scam 2022

TD Ameritrade Secure Log-In for online stock trading and long term investing clients.

. Individual Tax Return Form 1040 needs to be filed with the IRS by April 15 in most years. TD Ameritrade does not provide tax advice. Steps to access your T5 through online banking.

TD Ameritrade was evaluated. You pay tax on it if you profit income tax rate if short term capital gains. TD Ameritrade hosts an OFX server from which your 1099-B realized gain and loss information may be retrieved by our program.

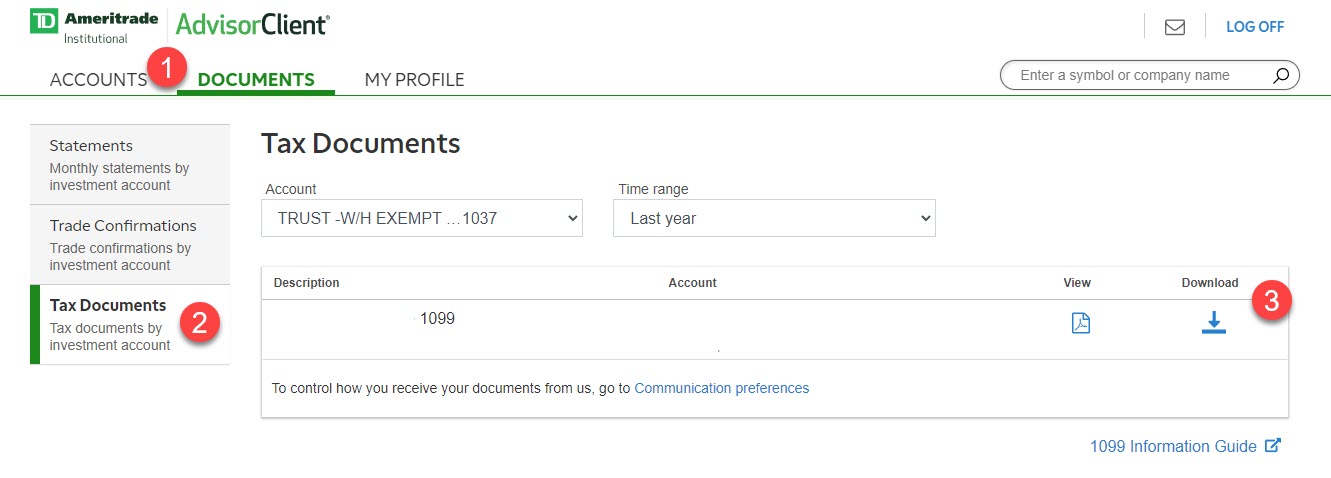

Calls are different than puts. Under the My Accounts list in the left hand column click View e-Documents. Have you talked to a tax professional about this.

If you have any questions please contact your Advisor or call TD. Understanding Form 1040. To retrieve information from their server you will.

Posted on March 10 2017 by admin. The topic of this. Under the Documents listing locate your T5.

TD Ameritrade does not report this income to the IRS. If you hold covered securities with tax-exempt original issue discount OID it will now be reported to the IRS on Form 1099-OID. Options that differ in strike or expiration date can not create a wash sale.

If you have any questions please contact your Advisor or call TD Ameritrade Institutional at 800-431-3500. TD Ameritrade does not report this income to the IRS. Anything else you want the.

Does Ameritrade report to the IRS. TD Ameritrade does not report this income to the IRS. Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content.

Have you talked to a tax professional about this. My TD Ameritrade Tax Statement shows. Under the Documents listing locate your T5.

Its hard to figure the rule that TD. Form 1099 OID - Original Issue Discount. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

3 Supplemental Summary Page A snapshot of the additional information that TD. The IRS defines the maximum that can be contributed into a 401 k in IRC Section 415. For example I bought.

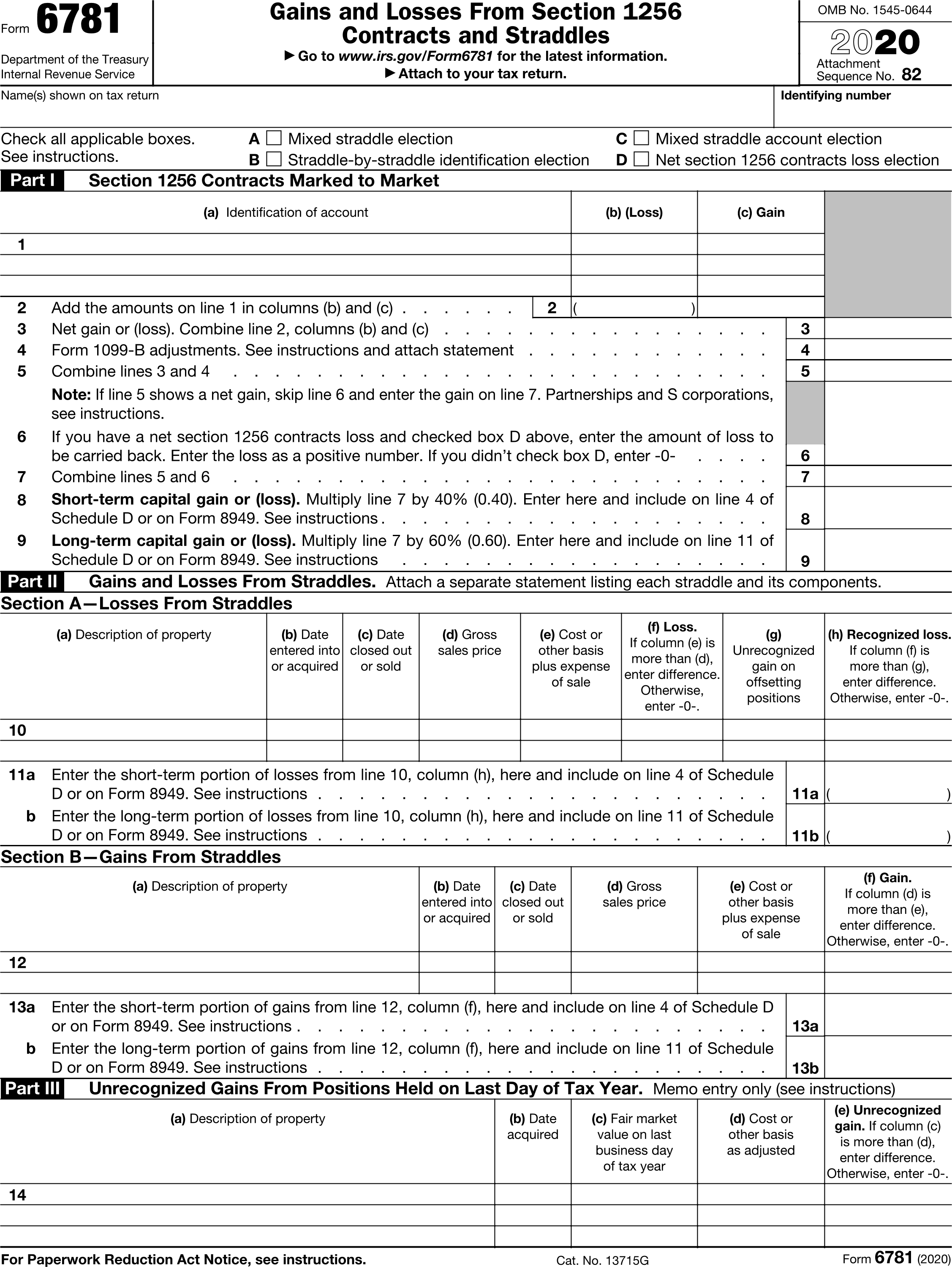

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

1099 Information Guide Td Ameritrade 1099 Information Guide Td Ameritrade Pdf Pdf4pro

Td Ameritrade Review A Leading Online Stock Broker

How To Report Other Receipts And Reconciliations Partnership Distributions Received On A 1099 B From Td Ameritrade On My Tax Return Quora

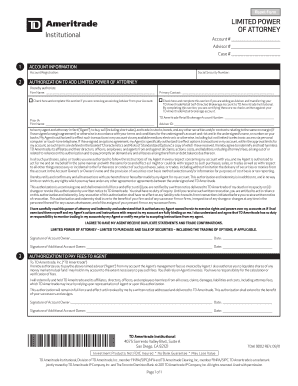

Fillable Online Td Ameritrade Limited Power Of Attorney Strategic Money Report Fax Email Print Pdffiller

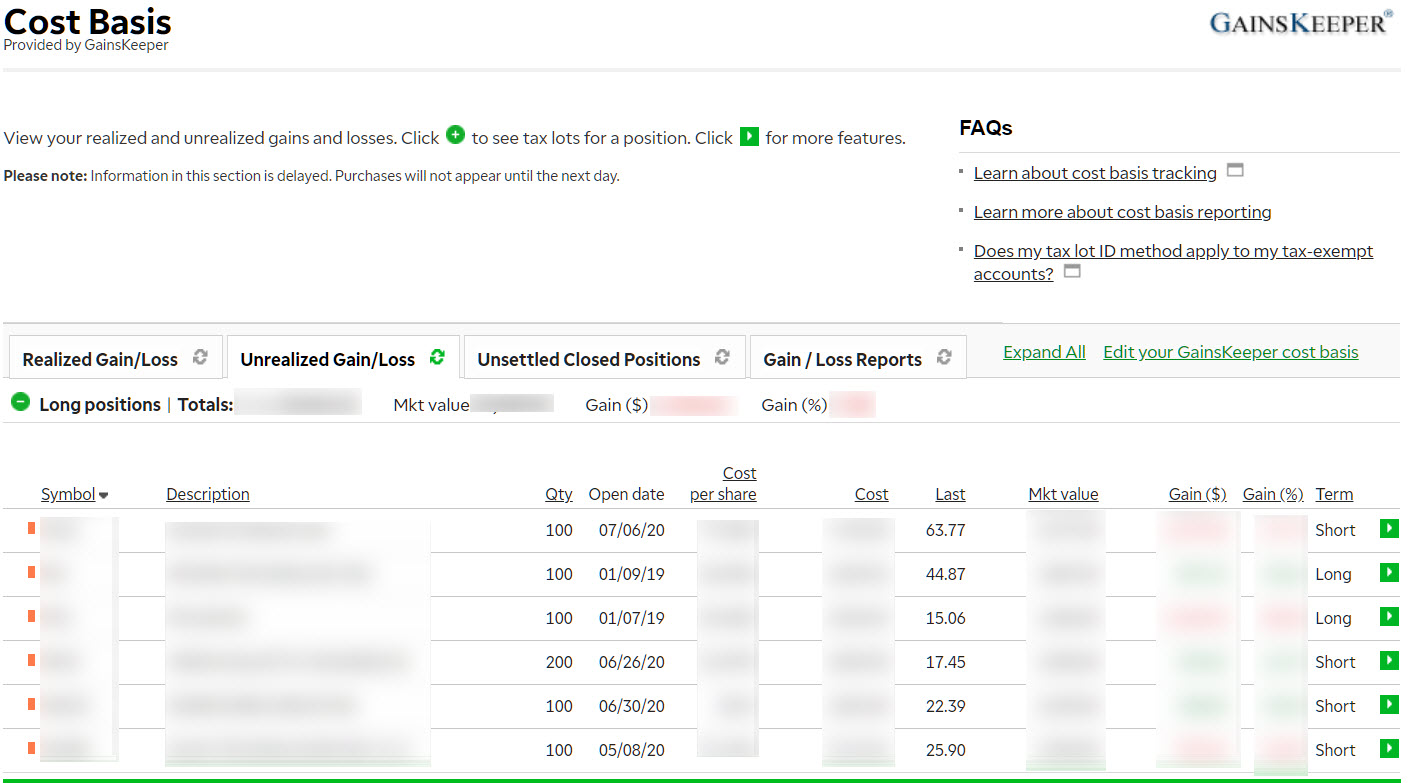

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Td Ameritrade Reviews Read Customer Service Reviews Of Tdameritrade Com

Is Td Ameritrade Safe Legit Is Td Ameritrade A Scam 2022

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Td Ameritrade Says I Made 196k In 3 Months R Tax

Td Ameritrade Review 2022 The College Investor

Robinhood Vanguard Td Ameritrade Affected By Stock Trading Outages

How To Process A Td Ameritrade Conversion Of Voluntary After Tax Solo 401k Funds To A Roth Solo 401k My Solo 401k Financial

How To Sign Up For A Td Ameritrade Brokerage Account A Step By Step Guide Nasdaq

Td Ameritrade Trek Client Learning Center

Non Usa Persons With A Usa Brokerage Account Do I Owe Tax

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

Irs Form W 8ben Td Ameritrade Fill Online Printable Fillable Blank Pdffiller