cash app business account benefits

Paid Time Off Family Work from Home Wellness Healthcare Ownership Growth Retirement The Candidate Journey. Since late 2019 Bitcoin purchases incur a charge of 176.

How To Get Free Money On Cash App Gobankingrates

Individuals can also use the platform to make personal payments using a credit card instead of their Cash App balance for a 3 transaction fee.

. Cash App is not a complete alternative to a real checking account as it does not offer FDIC insurance. 1 Download Cash App Buy stocks and bitcoin with as little as 1. Cash App is a peer-to-peer payment service that allows you to send receive and request money.

Another option is linking your account to an existing bank card and using it to transfer money to and from your Cash App account. We want to help you plan for your future and take care of yourselfand your familytoday. Centralised Account Management System Manage any additional employee and business expense cards or.

Similar to banks Cash App will occasionally loan out money from users accounts to various institutions. Cash App Speed up your direct deposits With a Cash App account you can receive paychecks up to 2 days early. Payments received on business accounts are charged 275 of transaction amount.

Cash App also allows users to buy and sell bitcoin from their platform for a small service fee based on the current bitcoin market volatility. The money will appear in your Cash App account as credit. This is normally done by matching the payment to the associated invoices.

Credit card customers will pay a 3 fee whereas those who choose a bank account will pay a 4 charge but of course this will be charged to the recipient. Another benefit from verifying your Cash App account is the ability to buy and sell Bitcoin right from the platform. Cash App doesnt charge monthly fees fees to send or receive money inactivity fees or foreign transaction fees.

Cash App is a peer-to-peer digital payment app backed by Square that allows you to send and receive money through your bank account using your debit card. You Lose Money With Instant Deposits. 750 Cash-App-Transfer is pending your confirmation.

Send faster payments from your business bank account from the Cashplus banking app or Online banking. Cash App is often used to pay friends or family for instance after getting dinner together or splitting the cost of a trip. Is the Cash App safe to use.

Cash application is a part of the accounts receivable process that applies incoming payments to the correct customer accounts and receivable invoices. If you are so inclined you can invest in both stocks and cryptocurrency using your Cash App account. These widespread scams target random users to click on a link and enter their account details or tell them sensitive information over the phone.

If for some reason the payment cannot be. Customers with Cash App accounts can search your business by cashtag email address or phone number to send you a payment in the app or you can send requests to Cash App users. For business the personal Cash App account may not be ideal for many transactions.

Plus tracking dozens of Cash App payments could be an accounting and logistical nightmare. Anyone with a Cash App account can fund a nonprofit profile using a credit card or bank account. The Cash Card is best used for purchases only and not at ATMs where youll get charged an extra.

However this is not the case with Cash Apps personal account as it imposes a limit on transactions. Small Business Benefits The biggest benefit of Square Cash is how it eliminates the swipe. Businesses can also accept Cash App as a form of payment and charge a transaction cost of 275.

If your account is unverified you will have to go elsewhere if you want to invest in Bitcoin. The purpose of cash application process is to close all such invoices in the ERP for which the customer has paid. You can even invest in stocks and Bitcoin through the app.

Customers who possess the Cash App business account have an added benefit that allows them to transfer as many funds as they can without any limit. No interest earned on balance. Benefits of Cash App No fees on basic services.

QuickBooks Cash is a business bank account with debit card thats free to open has no minimum balance or required daily balance and no monthly service fee. Cash App balances dont earn interest which is an important aspect of a worthwhile deposit account. Invoicing and collecting payment will then take significantly less time.

Let us dive deeper into the cash application process flow to understand how it works and the. One advantage here is that your customer doesnt need to be physically present in order to pay you. Pay bills suppliers and employees easily.

How to Use Cash App on Amazon. No longer does your customer have to take out a credit card so you can swipe it through your Square reader or any other credit card machine. Banking services provided by and the QuickBooks Visa Debit Card is issued by Green Dot Bank Member FDIC pursuant to license.

In an Accounts Receivable world Cash application is when incoming payments from customers are matched with their respective open invoices. On May 22 2020 BBB reached out to Square regarding Cash App and unemployment benefits. The cashme link expands the functionality by allowing anyone to pay online using a credit or debit card.

Better customer service starts with being able to onboard new customers quickly and easily. In order to do this the first step is to determine where to apply the payments. Ability to scale as business grows.

As you can see automating your cash application process tends to create greater efficiency in other areas of your business. There are no fees for making payments when you connect Cash App to a bank account or debit card. Its free to use but you can only receive up to 1000 in a 30-day period until you go through the steps of verifying your account.

The main banking screen on Cash App. Aside from transferring money Cash App will provide you with a bank account and a debit card which you can use at any ATM. Plus ATM withdrawals are free when you have at least 300 coming in each month.

Benefits Our benefits are centered around making sure that people have what they need to grow and succeed without compromising who they are. A Cash App business account has transactional fee charges. An example of an SMS message would be.

The company responded that Cash App experienced multiple. Call email and text phishing.

![]()

Tax Reporting With Cash For Business

Cash App Vs Venmo How They Compare Gobankingrates

Why I Get My Money Back From Cash App Now Instant Money Cash How To Get Money

1 855 908 5194 How To Login Cash App Account App App Login Cash

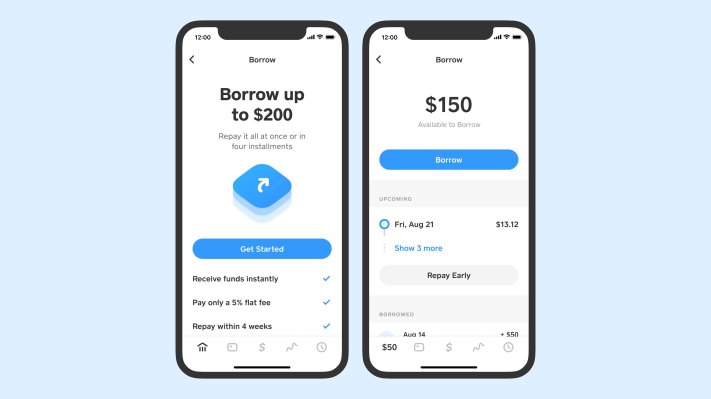

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

How To Get Free Money On Cash App Learn This New Cash App Hack To Get Free Money

Cash App Helps Cash App Helpful

How To Block Someone On Cash App In 2022 App Cash What Happens When You

Tax Reporting With Cash For Business

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

How To Create An Account On Cash App App Login App Cash

How To Add A Bank Account In The Cash App

How To Add A Bank Account In The Cash App

Is Facebook Marketplace An Online Business Website App Unlock Accounting

How To Create Cash App Account In Nigeria Buy And Sell And Cash App Funds Free Money Hack Cash Business Cards Corporate Identity

/Screenshot2021-11-09at11.35.14-7476aa727d4c4dae82727b2800eb6234.jpg)